What is the timeline for account disabling?

Accounts are sent from GMAS to the GL once a month for disabling. this occurs when an account is reconciled, and the account end date is over 90 days. They are sent to the GL on the 4th of every month, with the exception of quarter close (in which case it sends accounts to the GL on the 9th) and year end (in which case nothing is sent). The GL sends the reconciliation back to GMAS on the 10th of every month, with the exception of quarter close (in which case the GL reconciles with GMAS on the 18th) and year end (in which case there is no reconciliation).

What are some common reasons why accounts fail disabling?

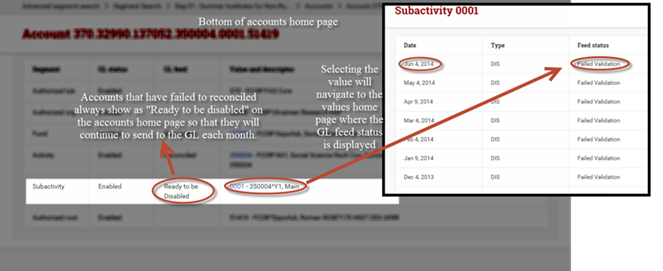

In some cases, an account can appear reconciled (income = final figure = expenses) in GMAS, but when the reconciliation comes back to GMAS it shows as failed validation,; this indicates that the account string cannot close in the GL. To see if your account is failing validation or successfully closing, navigate to accounts, then to the value that was sent to be disabled (fund or subactivity) and look for the date the value was sent to the GL.

The issue of values failing to validate is most commonly due to transactions being posted against the sponsored “activity-subactivity” but coded with another fund (non-sponsored fund or another sponsored fund). In order for an account to disable, the total balance of the sponsored “activity/subactivity” combination must net to zero in the General Ledger. To identify these situations, the department can run a GL Detail Listing Report for the sponsored “activity/subactivity” and sort by fund (selection criteria: enter the specific activity and sub-activity and ALL for fund/tub/org/object code/root). Some common examples of accounts failing at the GL are:

1. Current Fiscal Year Cost share balances (using companion accounts)

Example: Tub.Org.xxxx.026670.377171.1001.00000 (cost share expenses $24,702.70)

If the use of a companion account is correct and the expenses are not invalid code combinations requiring correction, OSP will process a journal to transfer the cost share balances to an all zero subactivity (0000) as below, so the net balance of the sponsored “activity/subactivity” combination nets to zero. \

Credit: Tub.Org.9300.026670.377171.1001.00000 ($24,702.70)

Debit: Tub.Org.9300.026670.377171.0000.00000 $24,702.70

Resolution: Departments can notify OSP of the balance related to the sponsored “activity/subactivity” that needs to be adjusted and OSP can process a journal to reconcile the sponsored “activity/subactivity”. This should be done as part of the final award close-out when the final financial report or review is completed. NOTE: at the end of the fiscal year, there is an automated balance forward entry that will zero out companion accounts.

2. Unreconciled Work In Process (WIP, balance sheet object codes 1151, 1153)

Example: Tub.Org.1151.000000.335362.0001.00000 $ 7,438.23

For WIP balances on the object code#1151, the department should contact the tub Finance Office or tub Equipment Manager for assistance. The tub Finance Office or Equipment Manager will notify the Fixed Asset Accounting Office to place the fabrications “in service”. The Fixed Asset Accounting Office will process a credit journal entry (obj.1153) to reconcile the WIP balance (obj.1151) on the sponsored activity/subactivity combination. If the fabrication is not put into service, then the Finance Office will work the Fixed Asset Accounting Office on the proper disposition and accouting.

Resolution: Departments should notify their Finance Office or Equipment Manager about any WIPs that have not been put into service or that need to be dispositioned.

3. Invalid code combinations (an invalid fund used with sponsored activity/subactivity)

Resolution: Departments can process a journal entry to correct the invalid code combination. Such journals must comply with the University Cost Transfer policy.